No hassles. No BS. Easy to implement, proven digital solutions for Credit Unions.

Whether it’s hybrid digital advice or self-directed investing, FusionIQ brings them both together in a single investor journey for banks. Give your members the digital investing experience they want in a white labeled platform that helps you build your brand.

Solutions / Credit Unions

5 Minutes

to Onboard a New or Existing Client

6 Weeks

to Implement a White Label Platform

115,000+ Investors

on FusionIQ One

FusionIQ integrates with many of the largest and most trusted custodians

Become a Digital Leader

Credit Unions are facing pressure to deliver digital services to their members.

Many credit unions are seeing significant ACH outflows to D2C digital investing platforms. At the same time, a digital demographic is requesting a better experience on the device of their choice. Credit unions are looking to digital wealth partners who can help them deliver the solutions necessary to retain and attract members.

FusionIQ makes it easy for credit unions to implement new investment services for their members with FIQ Journey. Join other leading credit unions who are realizing profitable organic growth with our digital solutions.

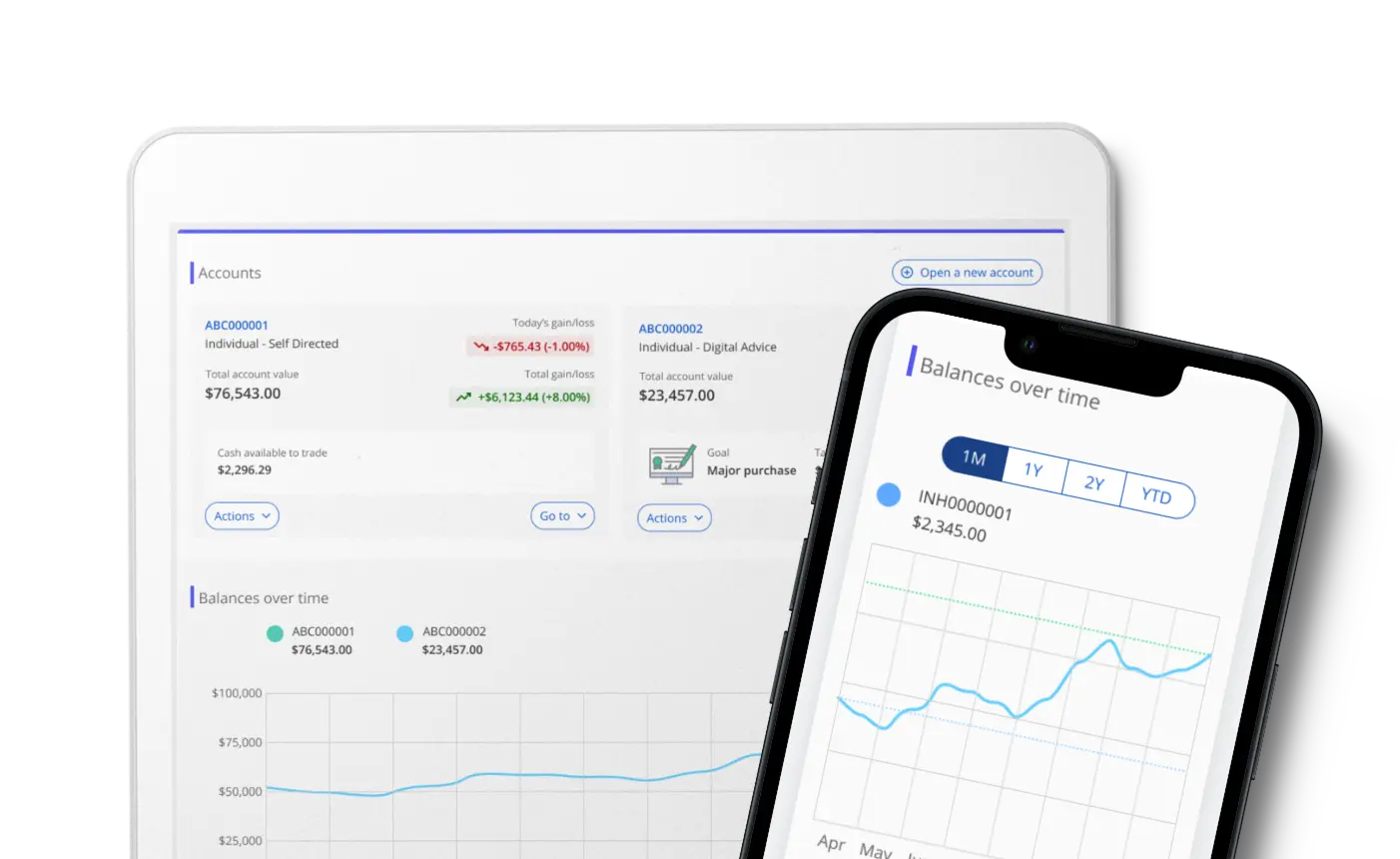

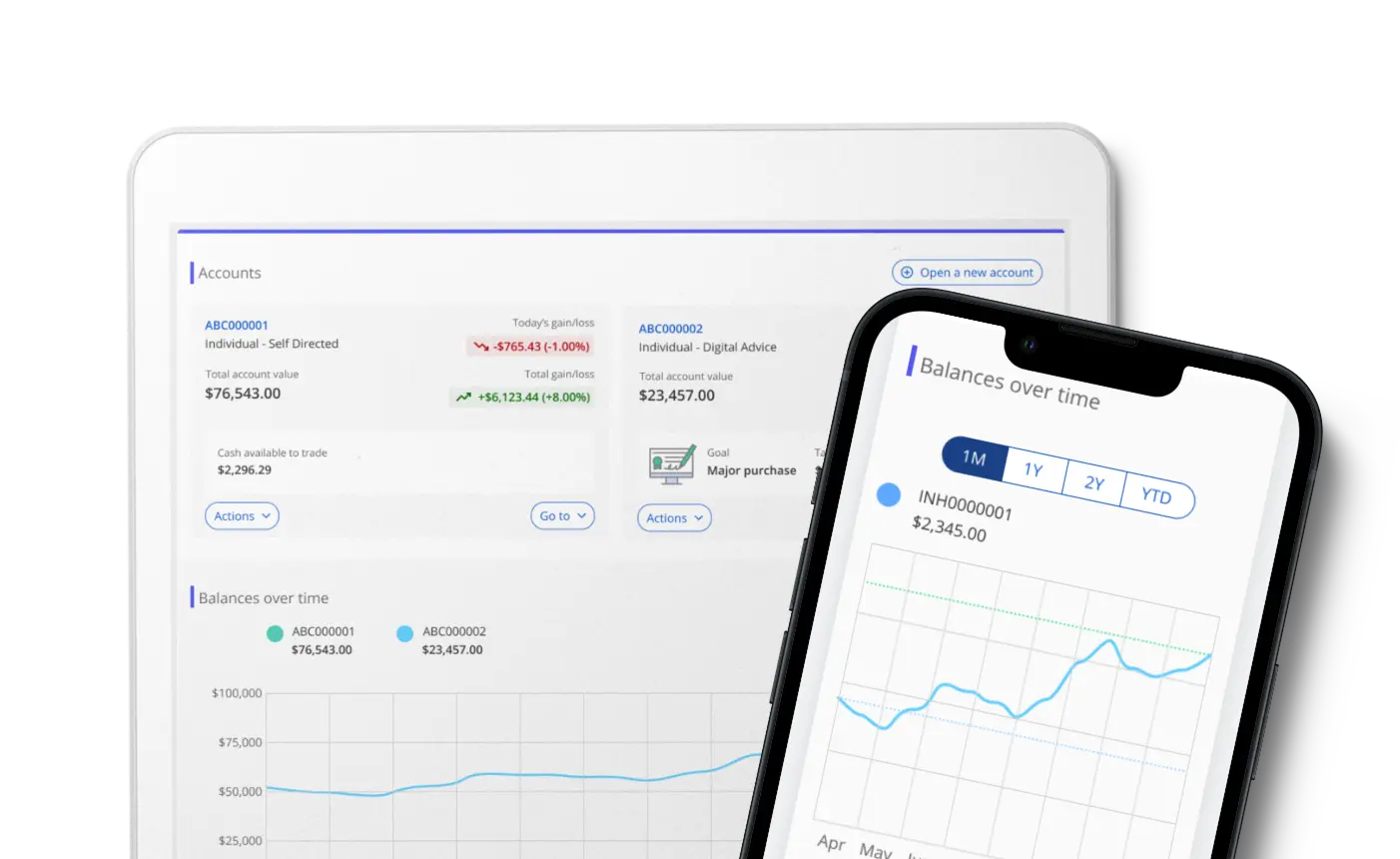

FIQ Journey

Whether your goal is attracting and retaining members, providing your members with self-directed brokerage so they can make their own trades, delivering faster client onboarding, or providing digital advice for your mass affluent and digital first members, FIQ Journey brings together Hybrid Digital Advice and Self-Directed Investing in a single digital investor journey to help you start achieving your goals in as little as six weeks.

Winning

the Digital Game

Winning

the Digital Game

America's Best All-in-one Platform

FusionIQ Declared Winner at 2024 Banking Tech Awards USA.

Goals-based Investing

Helping members focus investing on life goals lets you deepen relationships. From goal identification during onboarding to an innovative goals calculator and a status tracker on the member dashboard, you create better financial outcomes.

Meaningful Data Insights

The advanced FusionIQ One platform moves beyond data aggregation to provide transactional data, replacing several custodial back offices with the advisor portal.

Multi-Custodian Platform

FusionIQ integrates with many of the largest and most trusted custodians to minimize conversion risk.

Mobile App

Whether it’s using our mobile app, or integrating our solution into yours, we deliver the mobile experience your members want.

Streamlined Digital Compliance

Our compliance friendly platform delivers AML, KYC, and CIP tracking.

Seamless Integration of Back-Office Services

From compliance to reporting and custody, the FusionIQ One advisor portal seamlessly integrates your support functions giving you the ability to grow at scale.

Notifications & Alerts

FusionIQ One helps advisors manage their practice with notifications and alerts that keep you on top of your client activity.

Meaningful Data Insights

The advanced FusionIQ One platform moves beyond data aggregation to provide transactional data, replacing several custodial back offices with the advisor portal.

Credit union managing $9.4B empowers clients with DIY investing

FusionIQ appoints former Fidelity leader as senior strategic advisor

Digitally-Enabled Investment Management Platforms: 2023 Advancements and 2024 Expectations

FusionIQ Partners With Avantis Investors For Advisor Access To Funds Lineup

An award-winning digital wealth management platform

Best Digital Solution Provider – WealthTech FinTech Futures Banking Awards 2024

Best Wealth Management Solution 2024 Global BankTech Awards

Finalist 2024 Credit Union Times Luminaries Awards

Best Wealth Management Solution 2024 Global BankTech Awards

Excellence Awardee WealthTech Provider of the Year InvestmentNews Awards 2024

Best as-a-Service Solution for Wealth Management Banking Tech Awards USA 2024

Excellence Awardee WealthTech Provider of the Year InvestmentNews Awards 2024

Double Finalist 2024 ThinkAdvisor Luminaries Awards

Teams and Branch Management

From office teams to multi branch hierarchy, FusionIQ One gives organizations the flexibility to seamlessly manage permissions and controls, whatever your size and structure.

Single Sign On (SSO)

For organizations using SSO, FusionIQ One Plus can quickly integrate to further enhance the employee and client experience.

CRM Integrations

FusionIQ One Plus integrates with leading CRMs like Red Tail and Salesforce to let you get even more out of your Digital Advice.

Additional Investment Journeys

We understand that some of our clients want additional investment journeys. FusionIQ One Plus provides additional investment channels including digital assets, alternatives investments, private securities, and fixed income.

United States

United States